Sers retirement chart

Appendix A provides a quick reference chart for actual State service vesting service and credited service and is attached at the end of this SPD. It is important to note that these benefits are not always dollar for dollar offsets to your SERS retirement benefit but rather are just one component used in.

2

Plan structure Plan 2 The benefit in Plan 2 is based on the length of time youve worked your pay and your age at retirement.

. Retirement benefits through the Connecticut State Employees Retirement System SERS or the Plan. Staff and CPs hired prior to September 28 2016 elected retirement from the School Employees Retirement System OHSERS. Retirees will only reenter membership if they elect to do so.

For example if inflation bounced between 6 and 0 for four years in a row 6 0 6 0 your plan would still see a consistent 3 increase each year. Mondays Meaningful Message for August 8 2022. Applying for SERSSTRS refund for former employees.

Auditor of State Award. Costs for Stipend - Dependent Allowance. Employer Support Services Department of Retirement Systems PO Box 48380 Olympia WA 98504-8380.

21 days of sick. Benefits - TIAA-SERS Retirement - Allowable FA. 830 am 430 pm State Holidays.

Choose a plan This page offers reasons customers give us for choosing one plan or the other. The decision you make is permanent and we have several resources to help you select which plan is right for you. COLA banking provides a form of smoothing for you as well as the plan.

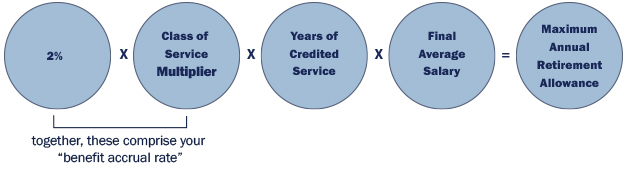

There are several components used in the determination of the amount of your SERS disability retirement benefit. Comments here a just sore loosers and putin lovers. Applying for SERSSTRS refund for former employees.

6835 Capitol Boulevard Tumwater WA 98501. Sick Leave and Vacation Chart. Commonly nicknamed the Rocket Man after his 1972 hit single of the same name John has led a commercially successful career as a solo artist since the 1970s having released 31 albums since 1969.

The statutory benefit the 100 maximum the 80 maximum and the 60 minimum. Ken Roth Aug 09 2022 955AM ET. These emails may appear to come from SERS or appear to represent SERS they do not.

If a SERS retiree reenters membership benefits stop until the member retires again. To learn more about the ARP please review the Alternative Retirement Plan Tab. This means that a reemployed State Employees Retirement System SERS retiree at a state university or the.

Used in the example in the Estimating PLOP Cost section below. In looking at the chart that would be. To determine what your basic monthly benefit will be divide your annual retirement by 12.

Cost of benefits provided to employees for TIAA-SERS retirement Central Use Only NOT to be used in transactions for acquiring goods andor services. Sir Elton Hercules John CH CBE born Reginald Kenneth Dwight. Many SERS members have recently received unsolicited potentially misleading emails from companies not affiliated with SERS offering retirement counseling.

Plan 2 or Plan 3. Veterans Parkway Springfield. Department of Retirement Systems PO Box 9018 Olympia WA 98507-9018.

Recruiting Bus Drivers an Ongoing Challenge. Applying for SERSSTRS refund for former employees. News About 2021 IRS Child Tax Credit.

State Teachers Retirement System of Ohio 8882277877 275 E. Glover Principal Addresses Board Upon Retirement. The following chart is a quick check reference chart showing varying types of service and whether each qualifies as actual state vesting or credited service in the Hybrid Plan.

Paid Sick Vacation Time. To learn more about the options offered by OHSERS please visit the SERS website or contact them directly at 1-866-280-7377. Divide the annual index number from the prior year by the index number for the year prior to that.

Careers - Current Job Openings - Employment. Recruiting Bus Drivers an Ongoing Challenge. Reference Chart for Actual State Vesting And Credited Service.

Benefits - Stipend - Dependent Allowance - Allowable FA. SERS Contact Information 2101 S. Mondays Meaningful Message for August 8 2022.

The following chart provides a brief summary of the membership rules in effect for prior periods. Youll receive a benefit for the rest of your life. If you receive a lump sum payment for sick leave vacation or personal days when you retire you may establish credit for this time to meet service eligibility requirements and increase your retirement benefit by making the required contributions on a pre or post-tax basis.

Tuzər is a city in southwest TunisiaThe city is located northwest of Chott el Djerid in between this Chott and the smaller Chott el GharsaIt is the capital of Tozeur GovernorateIt was the site of the ancient city and former bishopric Tusuros which remains a Latin Catholic titular see. Auditor of State Award. Most retirement plans with a cost of living adjustment either have a hard cap or no cap at all.

The option may be exercised prospectively. The amount contributed to a designated Roth account is includible in gross income in the year of the contribution but eligible distributions from the account including earnings are generally tax-free. A designated Roth account is a separate account in a 401k 403b or governmental 457b plan that holds designated Roth contributions.

SERS is a defined benefit plan and is intended to meet the requirements of the Internal. The following chart is a quick check reference chart showing varying types of service and whether each qualifies as actual state vesting or credited service in Tier II. SERS retirees are exempt from SERS membership.

Auditor of State Award. Collaborating with lyricist Bernie Taupin since 1967. New public employees school employees and teachers have 90 days to choose between two retirement plans.

State Teachers Retirement System of Ohio 8882277877 275 E. Glover Principal Addresses Board Upon Retirement. 25 March 1947 is a British singer pianist and composer.

Replace the attached chart with a new chart. The above chart provides you with your annual benefit. Unused sick leave chart.

In the example estimate below a 60-year-old member in the Defined Benefit Plan with a 3000. This means that the calculated COLA is 33. Both you and your employer contribute to your plan.

School Employees Retirement System Plan 2 and 3 Defined Benefit Fund membership is limited to classified school district and educational service district employees who were members of PERS Plan 2 on September 1 2000 and did not transfer to SERS 3 and former members of PERS 2 who enter employment in a SERS covered position after September 1. The payments are guaranteed by the state of Washington. For the COLA applied in 2018 the index for 2017 is divided by the index for 2016.

A sample Partial Lump-Sum Option Plan PLOP Payment estimate appears belowYou can also estimate benefits with a PLOP payment by using the service retirement estimate calculator.

As You Prepare For Retirement You Have A Number Of Decisions To Make Regarding Your Sers Retirement Benefit You Will Document Your Decisions On A Retirement Estimate Request Researching And Considering All Of Your Options Well In Advance Of Your

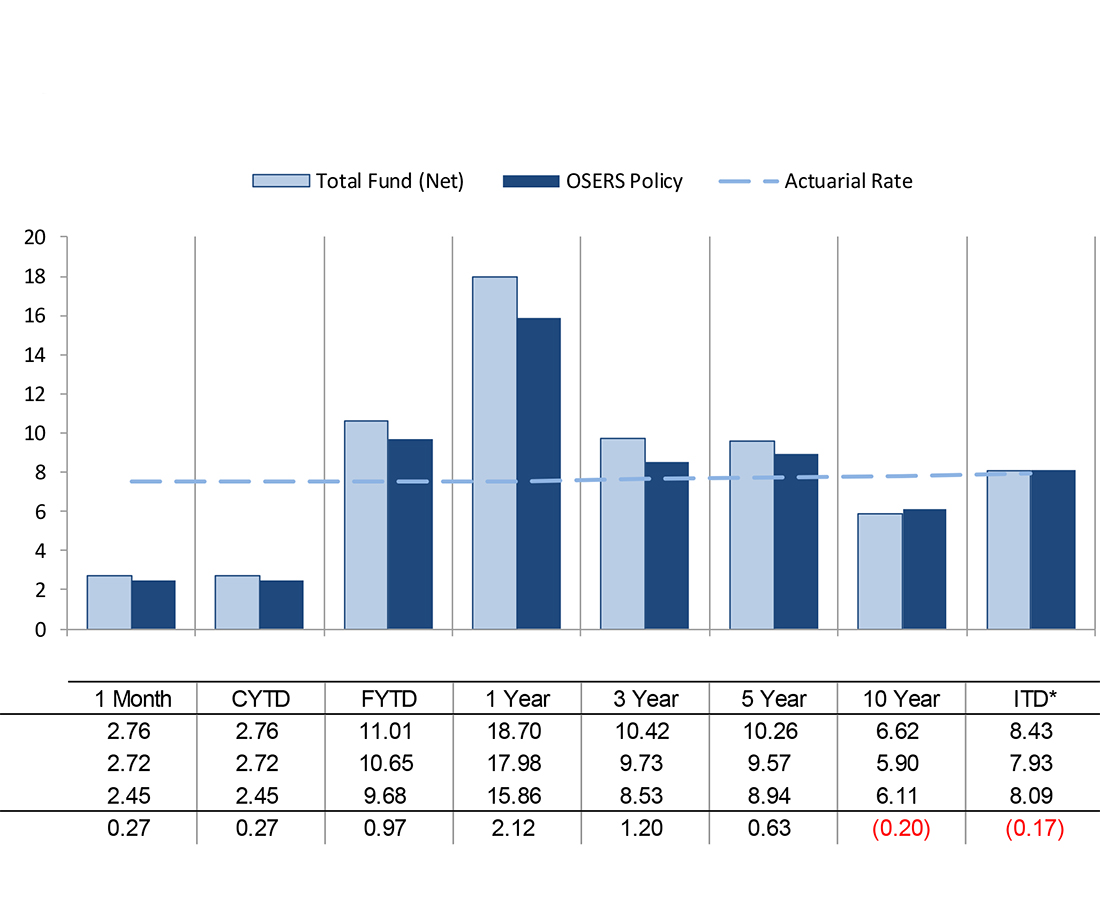

Financial Information School Employees Retirement System Ohio Sers

School And State Finance Project State Employees Retirement System Sers

School And State Finance Project State Employees Retirement System Sers

2

Sers Ohio Sets Private Equity Objectives For 2022 Buyouts

Cost Of Living Adjustment Cola Sers

Freedom Of Information Act Foia Information Contact Sers

Pin On Hdb

Refunds Sers

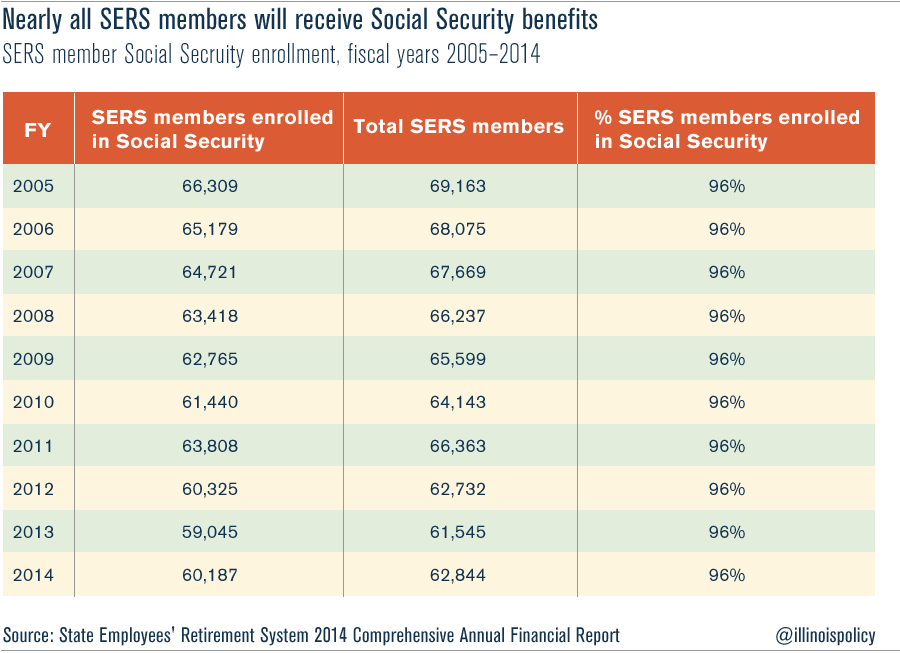

Who Says Illinois State Workers Don T Get Social Security

Financial Information School Employees Retirement System Ohio Sers

School And State Finance Project State Employees Retirement System Sers

2

Retirement Basics Sers

Sers Of Ohio Sets Infrastructure Portfolio Goals 2022 Infrastructure Investor

2