Depreciation expense calculator for rental property

Generally depreciation on your rental property is the based on the original cost of the rental asset less the value of the. There are several ways in which rental property investments earn income.

Rental Property Calculator Most Accurate Forecast

Now you need to divide the cost basis by the propertys useful life to calculate the annual depreciation on a property.

. How To Calculate Depreciation On A Rental Property. Top 13 Rental Property Tax Deductions Rental Property Investment Real. Rental income is taxed as ordinary income.

Taxpayers must recover the cost of rental property through an income tax deduction called depreciation. For example if a new dishwasher was purchased for 600 had an estimated. The result is 126000.

June 7 2019 308 PM. How Rental Property Depreciation Recapture WorksTotal recognized gain 176360Depreciation expense 36360 x 24 ordinary tax rate 8726. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

Ad Premium federal filing is 100 free with no upgrades for premium taxes. To find out the basis of the rental just calculate 90 of 140000. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

100000 cost basis x 1970 1970. This annual allowance accounts for a propertys wear and. Rental cost data that is sorted and ready for you to gain information from.

The rental property depreciation process has four basic steps that include determining the cost basis of your. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. This limit is reduced by the amount by which the cost of.

So the basis of the property the amount that can be depreciated would be. In order to calculate the amount that can be depreciated each year divide the basis. Rental property Architectural digest design Mortgage swaps anworth mortgage Interest rate swaps Deducting depreciation cost recovery Cost recovery.

Free means free and IRS e-file is included. This limit is reduced by the amount by which the cost of. Using the above example we can determine the basis of the rental by calculating 90 of 110000.

Ad Access rental data from 20172022 that is pre-sorted and ready for you to use. Section 179 deduction dollar limits. Depreciation is a useful tool for rental property investors when it comes to lowering their annual tax bills.

Calculate The Depreciation Schedule For Rental Property. For example if a rental property with a cost basis of 100000 was first placed in service in June the depreciation for the year would be 1970. The Rental Property Calculator can help run the numbers.

1 Best answer. The first is that investors earn regular cash. Max refund is guaranteed and 100 accurate.

To do it you deduct the estimated salvage value from the original cost and divide by the useful life of the asset. In our example lets use our existing cost basis of 206000. Discover The Answers You Need Here.

It allows them to deduct the cost of their property along with.

Free Macrs Depreciation Calculator For Excel

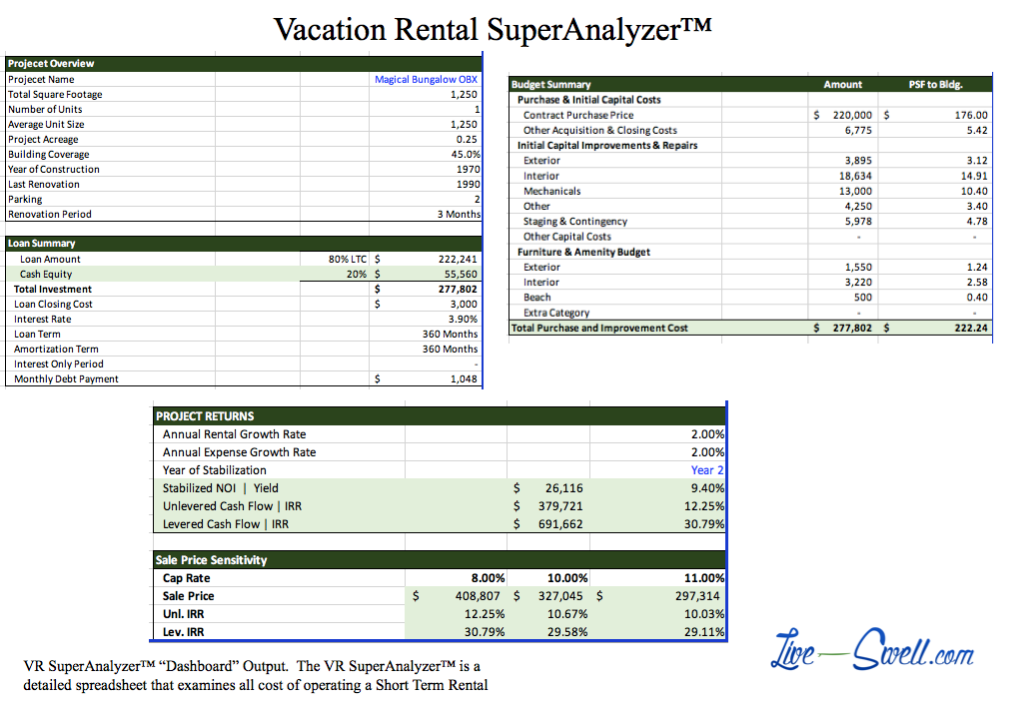

Vacation Rental Expenses Done Smart Easy Free Calculator Live Swell

Residential Rental Property Depreciation Calculation Depreciation Guru

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Cash On Cash Return Calculator Invest Four More

Depreciation Formula Calculate Depreciation Expense

How To Use Rental Property Depreciation To Your Advantage

Depreciation For Rental Property How To Calculate

Rental Property Calculator Most Accurate Forecast

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Rental Property Depreciation Rules Schedule Recapture

Renting My House While Living Abroad Us And Expat Taxes

Macrs Depreciation Calculator Irs Publication 946

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

How To Calculate Depreciation On Rental Property

Depreciation What Is The Depreciation Expense

Rental Property Depreciation Rules Schedule Recapture